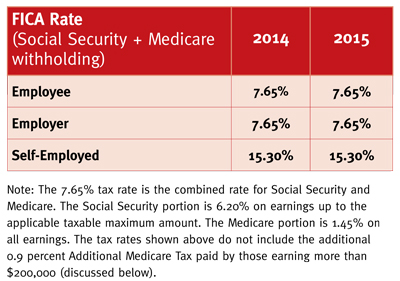

Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 22 dezembro 2024

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

New Rules and Regulations for 2015 Payroll Taxes

Payroll Tax Rates (2023 Guide) – Forbes Advisor

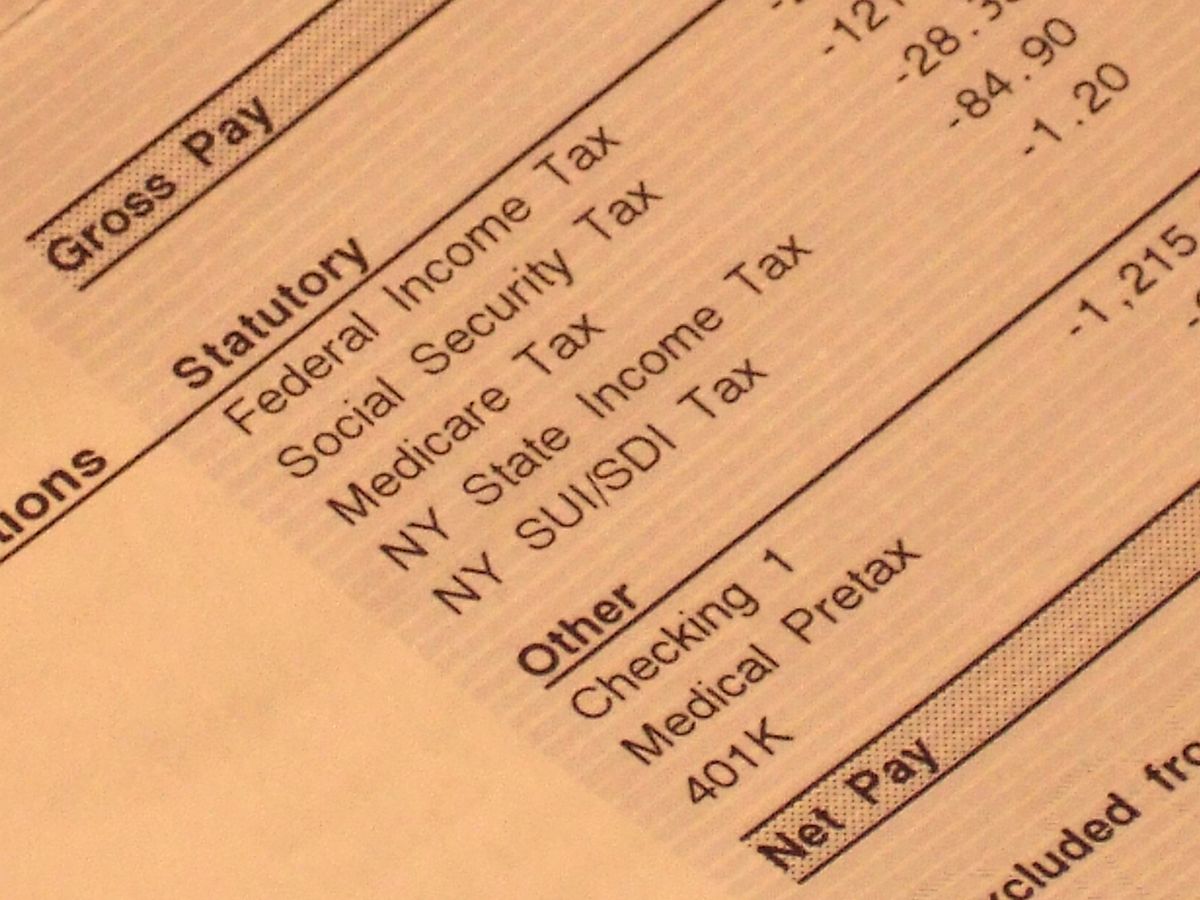

Understanding payroll tax & how to calculate it

FICA and Withholding: Everything You Need to Know - TurboTax Tax

Answered: Oriole's payroll taxes are Social…

FICA Tax Exemption for Nonresident Aliens Explained

What is FICA Tax? - The TurboTax Blog

What is FICA tax?

2017 FICA Tax: What You Need to Know

How to Pay Social Security and Medicare Taxes: 10 Steps

Recomendado para você

-

What is FICA Tax? - Optima Tax Relief22 dezembro 2024

What is FICA Tax? - Optima Tax Relief22 dezembro 2024 -

Social Security and Medicare • Teacher Guide22 dezembro 2024

-

What is a payroll tax?, Payroll tax definition, types, and employer obligations22 dezembro 2024

What is a payroll tax?, Payroll tax definition, types, and employer obligations22 dezembro 2024 -

2021 FICA Tax Rates22 dezembro 2024

-

Withholding FICA Tax on Nonresident employees and Foreign Workers22 dezembro 2024

Withholding FICA Tax on Nonresident employees and Foreign Workers22 dezembro 2024 -

What Is FICA Tax?22 dezembro 2024

What Is FICA Tax?22 dezembro 2024 -

What Is FICA Tax? —22 dezembro 2024

What Is FICA Tax? —22 dezembro 2024 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and22 dezembro 2024

-

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg) What Is Social Security Tax? Definition, Exemptions, and Example22 dezembro 2024

What Is Social Security Tax? Definition, Exemptions, and Example22 dezembro 2024 -

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset22 dezembro 2024

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset22 dezembro 2024

você pode gostar

-

Grab Your FREE Desktop Wallpapers and Organisers22 dezembro 2024

Grab Your FREE Desktop Wallpapers and Organisers22 dezembro 2024 -

MINHA PRIMEIRA EXPERIÊNCIA EM UM PU 1 mi de visualizações - há 2 anos 103 mil Não22 dezembro 2024

MINHA PRIMEIRA EXPERIÊNCIA EM UM PU 1 mi de visualizações - há 2 anos 103 mil Não22 dezembro 2024 -

![Call of Duty®: Ghosts PC GAME [Offline INSTALLATION]](https://my-test-11.slatic.net/p/d74efd10dc2548cae23ede178f6b60f6.jpg) Call of Duty®: Ghosts PC GAME [Offline INSTALLATION]22 dezembro 2024

Call of Duty®: Ghosts PC GAME [Offline INSTALLATION]22 dezembro 2024 -

Assistir Kakkou no Iinazuke Episodio 1 Online22 dezembro 2024

Assistir Kakkou no Iinazuke Episodio 1 Online22 dezembro 2024 -

As Tempestades da Aventura de Sobrevivência Windbound Chegam ao PS4 em 28 de Agosto – PlayStation.Blog BR22 dezembro 2024

As Tempestades da Aventura de Sobrevivência Windbound Chegam ao PS4 em 28 de Agosto – PlayStation.Blog BR22 dezembro 2024 -

Vikings: Alexander Ludwig aka Bjorn Ironside turns 2922 dezembro 2024

Vikings: Alexander Ludwig aka Bjorn Ironside turns 2922 dezembro 2024 -

fotos mandrake desenho22 dezembro 2024

fotos mandrake desenho22 dezembro 2024 -

killing stalking manga Poster for Sale by agustuswilli22 dezembro 2024

killing stalking manga Poster for Sale by agustuswilli22 dezembro 2024 -

Half Moon Village and Beach House powered by Cocotel, Campo22 dezembro 2024

Half Moon Village and Beach House powered by Cocotel, Campo22 dezembro 2024 -

Aniversário do Google: 5 fatos curiosos - Web Stories Jornal22 dezembro 2024

Aniversário do Google: 5 fatos curiosos - Web Stories Jornal22 dezembro 2024