What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Last updated 22 dezembro 2024

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

Is Social Security Taxable? (2023 & 2024 Update)

How Social Security Tax Impacts Your Paycheck: A Comprehensive Guide - FasterCapital

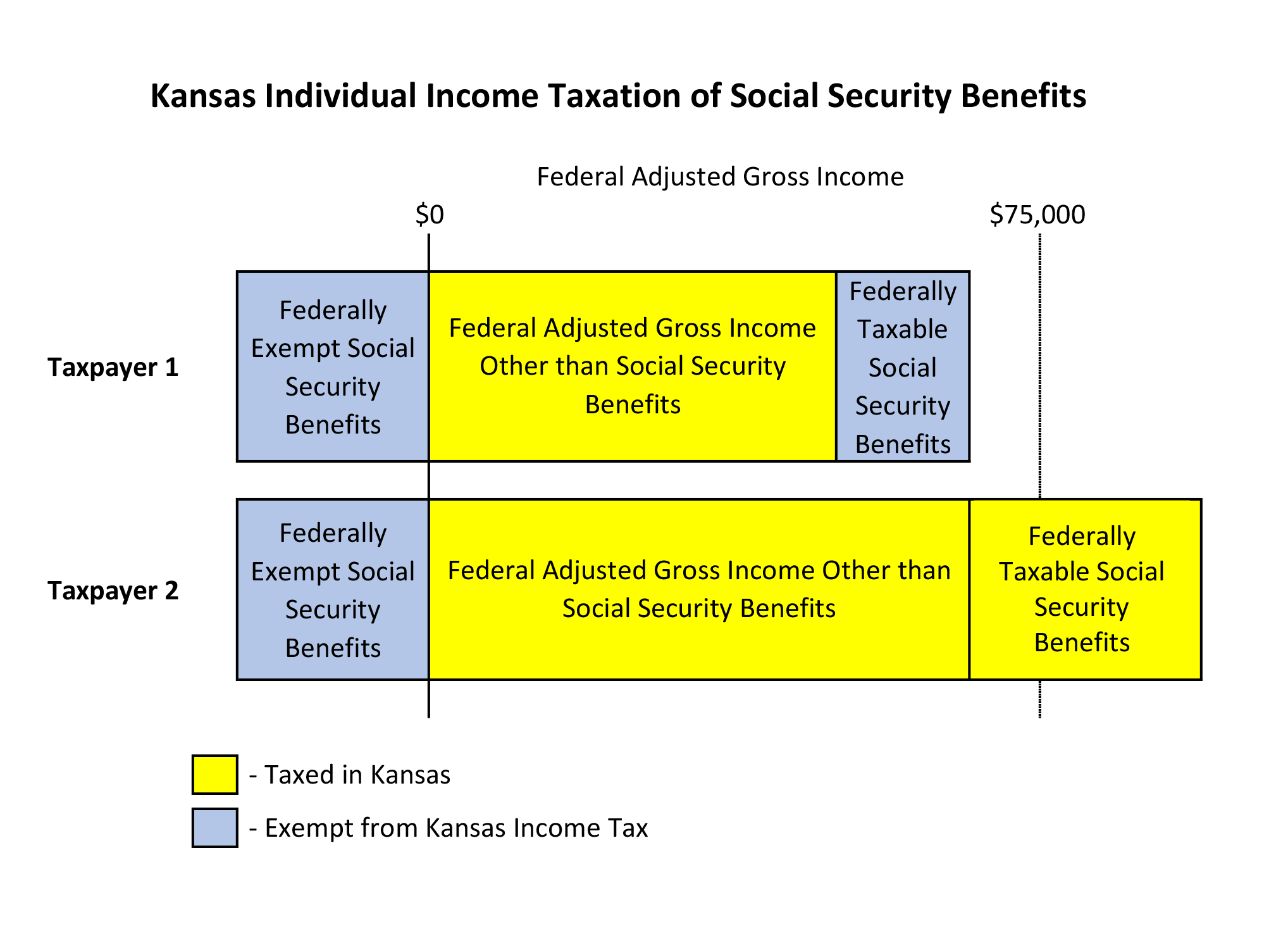

Income Taxation of Social Security Benefits – KLRD

Research: Income Taxes on Social Security Benefits

What is a 501(c)(3)? A Guide to Nonprofit Tax-Exempt Status - Foundation Group®

Program Explainer: Windfall Elimination Provision

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated?

The Evolution of Social Security's Taxable Maximum

Understanding Your Tax Forms 2016: SSA-1099, Social Security Benefits

Taxation in the United States - Wikipedia

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

What to Know About Social Security Benefits and Your Taxes

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog22 dezembro 2024

-

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations22 dezembro 2024

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations22 dezembro 2024 -

Family Finance Favs: Don't Leave Teens Wondering What The FICA?22 dezembro 2024

Family Finance Favs: Don't Leave Teens Wondering What The FICA?22 dezembro 2024 -

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg) Why Is There a Cap on the FICA Tax?22 dezembro 2024

Why Is There a Cap on the FICA Tax?22 dezembro 2024 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations22 dezembro 2024

What is a payroll tax?, Payroll tax definition, types, and employer obligations22 dezembro 2024 -

FICA Tax in 2022-2023: What Small Businesses Need to Know22 dezembro 2024

FICA Tax in 2022-2023: What Small Businesses Need to Know22 dezembro 2024 -

.jpg) What is FICA tax? Understanding FICA for small business22 dezembro 2024

What is FICA tax? Understanding FICA for small business22 dezembro 2024 -

Vola22 dezembro 2024

Vola22 dezembro 2024 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine22 dezembro 2024

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine22 dezembro 2024 -

Keyword:current fica tax rate - FasterCapital22 dezembro 2024

Keyword:current fica tax rate - FasterCapital22 dezembro 2024

você pode gostar

-

Breaking Point: Paixão à Dança (2023) DVD-R AUTORADO22 dezembro 2024

Breaking Point: Paixão à Dança (2023) DVD-R AUTORADO22 dezembro 2024 -

MA 3692 by The Brazilian Times Newspaper - Issuu22 dezembro 2024

MA 3692 by The Brazilian Times Newspaper - Issuu22 dezembro 2024 -

opinion: “Crazy” is Not a Synonym for “Awesome”– notes on22 dezembro 2024

opinion: “Crazy” is Not a Synonym for “Awesome”– notes on22 dezembro 2024 -

AO ASHI T15: 9782382811009: Kobayashi, Yûgo, Thévenon, Anne-Sophie: Books22 dezembro 2024

AO ASHI T15: 9782382811009: Kobayashi, Yûgo, Thévenon, Anne-Sophie: Books22 dezembro 2024 -

My Hero Academia 7, Mangá em Português22 dezembro 2024

My Hero Academia 7, Mangá em Português22 dezembro 2024 -

Mommy Long Legs Coloring Pages - Get Coloring Pages22 dezembro 2024

Mommy Long Legs Coloring Pages - Get Coloring Pages22 dezembro 2024 -

Divine Halo – Dragon Ball Universe22 dezembro 2024

Divine Halo – Dragon Ball Universe22 dezembro 2024 -

One Piece Monkey D. Luffy Chest Scar - One Piece Luffy - Tapestry22 dezembro 2024

One Piece Monkey D. Luffy Chest Scar - One Piece Luffy - Tapestry22 dezembro 2024 -

Garena Free Fire Max – download, APK, release date22 dezembro 2024

Garena Free Fire Max – download, APK, release date22 dezembro 2024 -

A LUTA DE HADES VS QIN SHI HUANG SERÁ O PRIMEIRO EMPATE DO RAGNAROK22 dezembro 2024

A LUTA DE HADES VS QIN SHI HUANG SERÁ O PRIMEIRO EMPATE DO RAGNAROK22 dezembro 2024