FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

Por um escritor misterioso

Last updated 22 dezembro 2024

FICA explained: Social Security and Medicare tax rates to know in 2023

1040X Form (IRS): Definition & Instructions (Updated) - SmartAsset

What Is a Tax Exemption? - SmartAsset

What Is Social Security Tax? – Forbes Advisor

FICA Tax: Rates, How It Works in 2023-2024 - NerdWallet

Is the Employee Retention Credit Taxable Income? - SmartAsset

Got a Side Job or Freelance? Here's What You Need to Know About LLCs & Taxes

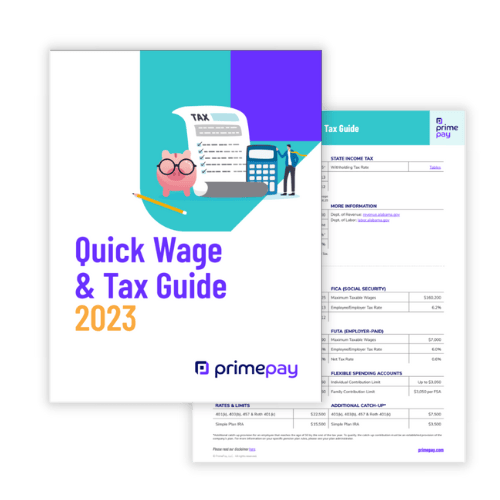

State Wage and Tax Guides Payroll Tax Rates & Limits By State

2023 FICA Tax Limits and Rates (How it Affects You)

A Guide to the Net Investment Income Tax (NIIT) - SmartAsset

What Are Trust Fund Taxes? - KAKE

How to File Self-Employment Taxes - SmartAsset

Employers: In 2023, the Social Security Wage Base is Going Up

J.P. Morgan: 5 Ways to Get Guaranteed Retirement Income

How Much Does Medicare Cost?

Recomendado para você

-

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About FICA, Social Security, and Medicare Taxes22 dezembro 2024

Learn About FICA, Social Security, and Medicare Taxes22 dezembro 2024 -

Social Security and Medicare • Teacher Guide22 dezembro 2024

-

What Is the FICA Tax and Why Does It Exist? - TheStreet22 dezembro 2024

What Is the FICA Tax and Why Does It Exist? - TheStreet22 dezembro 2024 -

2023 FICA Tax Limits and Rates (How it Affects You)22 dezembro 2024

2023 FICA Tax Limits and Rates (How it Affects You)22 dezembro 2024 -

What is the FICA Tax and How Does it Connect to Social Security?22 dezembro 2024

-

What is the FICA Tax? - 2023 - Robinhood22 dezembro 2024

-

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents22 dezembro 2024

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents22 dezembro 2024 -

2021 FICA Tax Rates22 dezembro 2024

-

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine22 dezembro 2024

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine22 dezembro 2024 -

Understanding FICA Taxes and Wage Base Limit22 dezembro 2024

Understanding FICA Taxes and Wage Base Limit22 dezembro 2024

você pode gostar

-

Help, I am an Ibiza clubbing virgin!22 dezembro 2024

Help, I am an Ibiza clubbing virgin!22 dezembro 2024 -

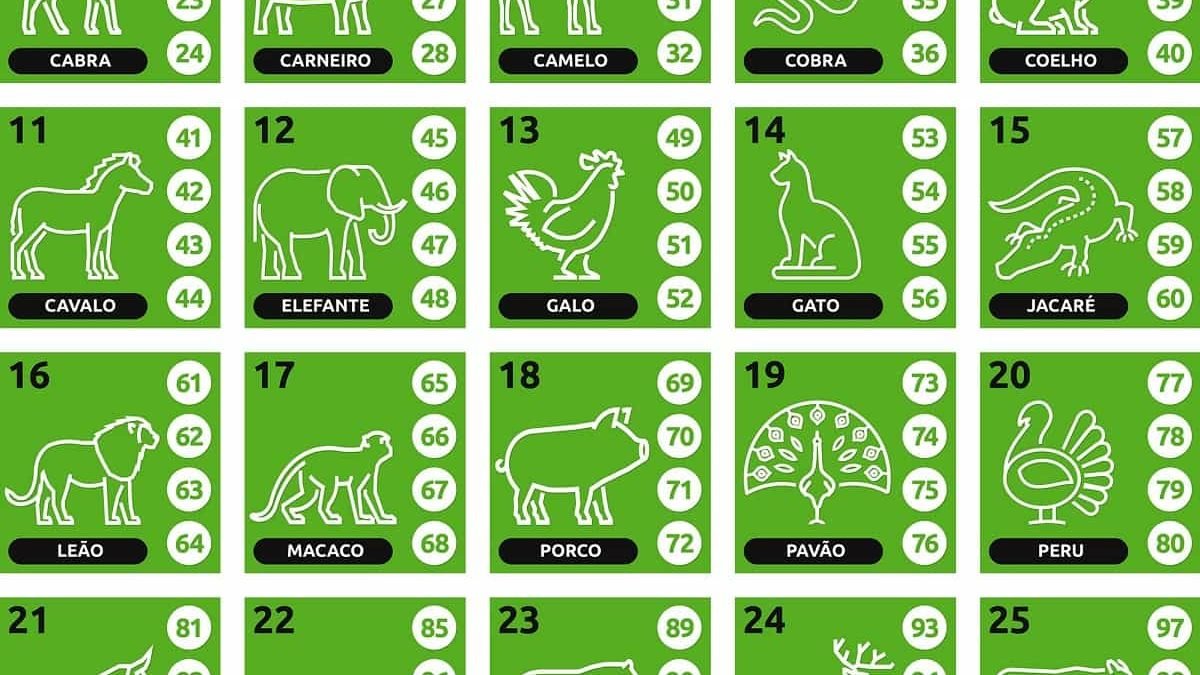

Sonhar com jogo do bicho - Simbolismo e Significado - Segredos do Sonho22 dezembro 2024

Sonhar com jogo do bicho - Simbolismo e Significado - Segredos do Sonho22 dezembro 2024 -

R$8005 POR DIA COM ESSA ESTRATEGIA NO JOGO DO TIGRE - DIA 20 FORTUNE TIGER GANHAR DINHEIRO 23.09.20222 dezembro 2024

R$8005 POR DIA COM ESSA ESTRATEGIA NO JOGO DO TIGRE - DIA 20 FORTUNE TIGER GANHAR DINHEIRO 23.09.20222 dezembro 2024 -

Ain't no way evade has almost 200k people : r/roblox22 dezembro 2024

Ain't no way evade has almost 200k people : r/roblox22 dezembro 2024 -

Warrior cat name generator 1 - copy Project by Nebula Horesradish22 dezembro 2024

Warrior cat name generator 1 - copy Project by Nebula Horesradish22 dezembro 2024 -

CJS CD Keys - FREE football manager 2022 Steam Key Give-away! One of our scanner monkeys made a mistake when scanning a batch of Football Manager 2022 keys recently, the photo was22 dezembro 2024

-

How to Catch Ditto in the Latest 'Pokémon Go' Update22 dezembro 2024

How to Catch Ditto in the Latest 'Pokémon Go' Update22 dezembro 2024 -

GTA Grand Theft Auto Vice City Stories Playstation 2 PS222 dezembro 2024

-

Tensei shitara Slime Datta Ken Movie「AMV」Onlap - Burn ᴴᴰ22 dezembro 2024

Tensei shitara Slime Datta Ken Movie「AMV」Onlap - Burn ᴴᴰ22 dezembro 2024 -

Jogos Sepahan ao vivo, tabela, resultados, Havadar SC x Sepahan ao vivo22 dezembro 2024

Jogos Sepahan ao vivo, tabela, resultados, Havadar SC x Sepahan ao vivo22 dezembro 2024