Learn About FICA, Social Security, and Medicare Taxes

Por um escritor misterioso

Last updated 22 outubro 2024

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn about what FICA taxes are, withholding Social Security and Medicare taxes from employee pay, and how to calculate, report, and pay FICA taxes to the IRS.

What Are FICA Taxes And Why Do They Matter? - Quikaid

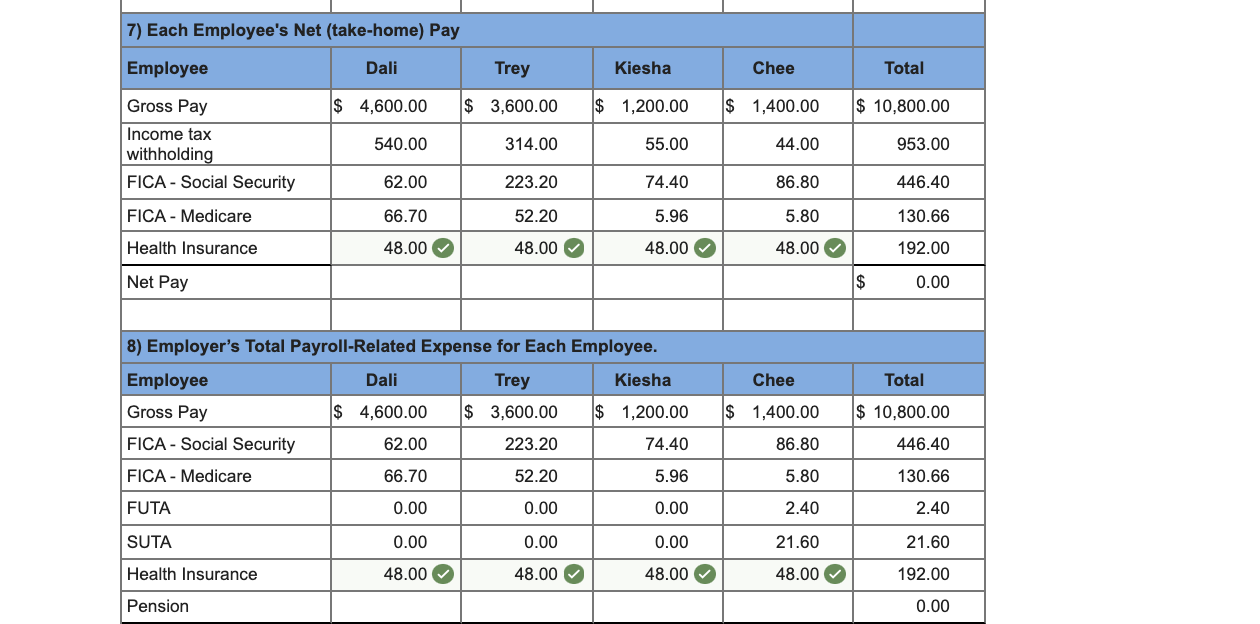

Solved Paloma Company has four employees. FICA Social

What is FICA tax?

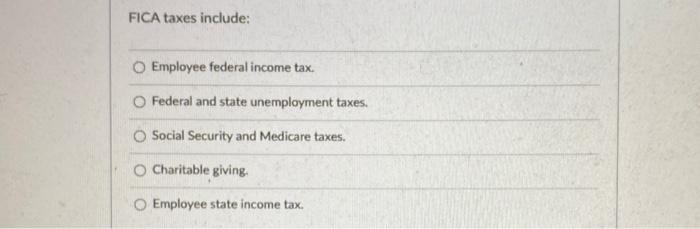

Solved FICA taxes include: Employee federal income tax. O

Learn About FICA Tax and How To Calculate It

What Are FICA Taxes? – Forbes Advisor

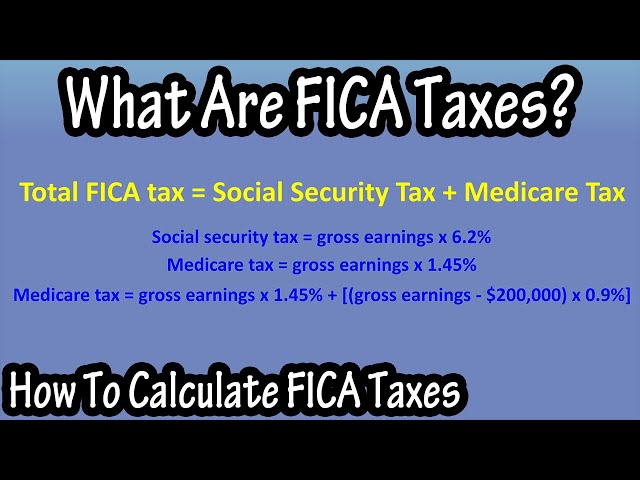

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

FICA Tax Exemption for Nonresident Aliens Explained

FICA Tax in 2022-2023: What Small Businesses Need to Know

Understanding FICA (Social Security and Medicare) Taxes - MyIRSteam

The Social Security tax rate for employees is 6.2 percent, a

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

What Is Social Security Tax? Calculations & Reporting Information

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions22 outubro 2024

-

What is Fica Tax?, What is Fica on My Paycheck22 outubro 2024

What is Fica Tax?, What is Fica on My Paycheck22 outubro 2024 -

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations22 outubro 2024

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations22 outubro 2024 -

What Is FICA Tax: How It Works And Why You Pay22 outubro 2024

What Is FICA Tax: How It Works And Why You Pay22 outubro 2024 -

2023 FICA Tax Limits and Rates (How it Affects You)22 outubro 2024

2023 FICA Tax Limits and Rates (How it Affects You)22 outubro 2024 -

Do You Have To Pay Tax On Your Social Security Benefits?22 outubro 2024

Do You Have To Pay Tax On Your Social Security Benefits?22 outubro 2024 -

How An S Corporation Reduces FICA Self-Employment Taxes22 outubro 2024

How An S Corporation Reduces FICA Self-Employment Taxes22 outubro 2024 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and22 outubro 2024

-

What Are FICA Taxes And Why Do They Matter? - Quikaid22 outubro 2024

What Are FICA Taxes And Why Do They Matter? - Quikaid22 outubro 2024 -

FICA Tax & Who Pays It22 outubro 2024

FICA Tax & Who Pays It22 outubro 2024

você pode gostar

-

Little Gems - Pinny's House by Peter Firmin22 outubro 2024

Little Gems - Pinny's House by Peter Firmin22 outubro 2024 -

Pergunta aleatória: Por que Shao - Galáxia Mortal Kombat22 outubro 2024

-

Funko Demon Slayer: Kimetsu No Yaiba Pop Moment Tanjiro & Nezuko Vs. Temple Demon Vinyl Figure Hot Topic Exclusive22 outubro 2024

Funko Demon Slayer: Kimetsu No Yaiba Pop Moment Tanjiro & Nezuko Vs. Temple Demon Vinyl Figure Hot Topic Exclusive22 outubro 2024 -

Truck Simulator USA Evolution apk mod dinheiro infinito 202222 outubro 2024

-

File:Tsuki to Laika to Nosferatu2 1.jpg - Anime Bath Scene Wiki22 outubro 2024

File:Tsuki to Laika to Nosferatu2 1.jpg - Anime Bath Scene Wiki22 outubro 2024 -

new classic sonic model and render! ( i used blender) : r22 outubro 2024

new classic sonic model and render! ( i used blender) : r22 outubro 2024 -

Stream Lugia's Song (The Great Guardian) from Pokemon 2000- The Movie by Matt Bardin (ASCAP)22 outubro 2024

Stream Lugia's Song (The Great Guardian) from Pokemon 2000- The Movie by Matt Bardin (ASCAP)22 outubro 2024 -

◤说黄道黑◢荷兰网红裸泡汤啊~Kimochi~ITS WET~22 outubro 2024

◤说黄道黑◢荷兰网红裸泡汤啊~Kimochi~ITS WET~22 outubro 2024 -

LITTLE NIGHTMARES 3 Will Feature Online Co-Op Multiplayer - PS4, PS522 outubro 2024

LITTLE NIGHTMARES 3 Will Feature Online Co-Op Multiplayer - PS4, PS522 outubro 2024 -

BANDAI NAMCO ONE PIECE Devil Fruit Ope Ope no Mi LED Room Light From Japan22 outubro 2024

BANDAI NAMCO ONE PIECE Devil Fruit Ope Ope no Mi LED Room Light From Japan22 outubro 2024