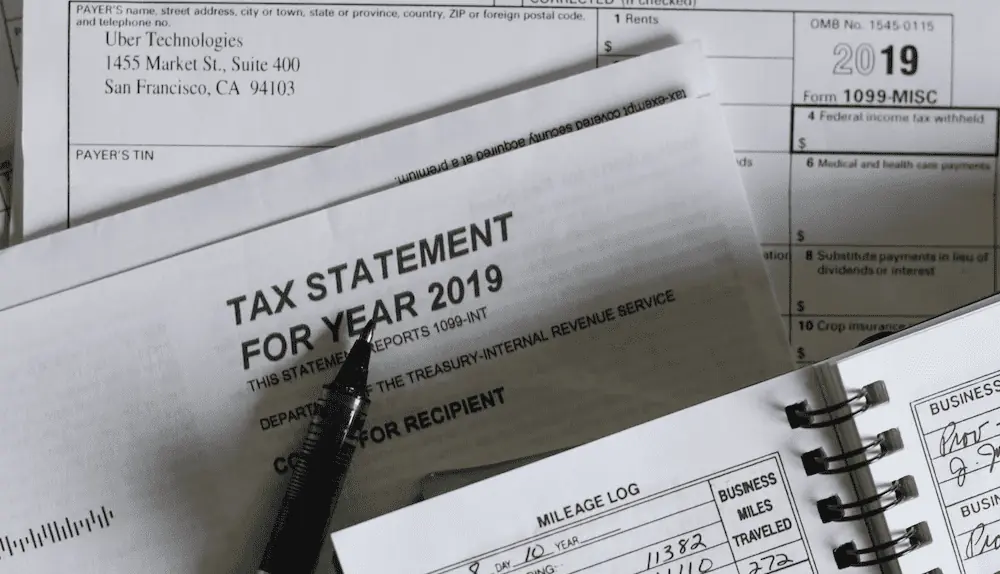

or Sale of $600 Now Prompt an IRS Form 1099-K

Por um escritor misterioso

Last updated 23 dezembro 2024

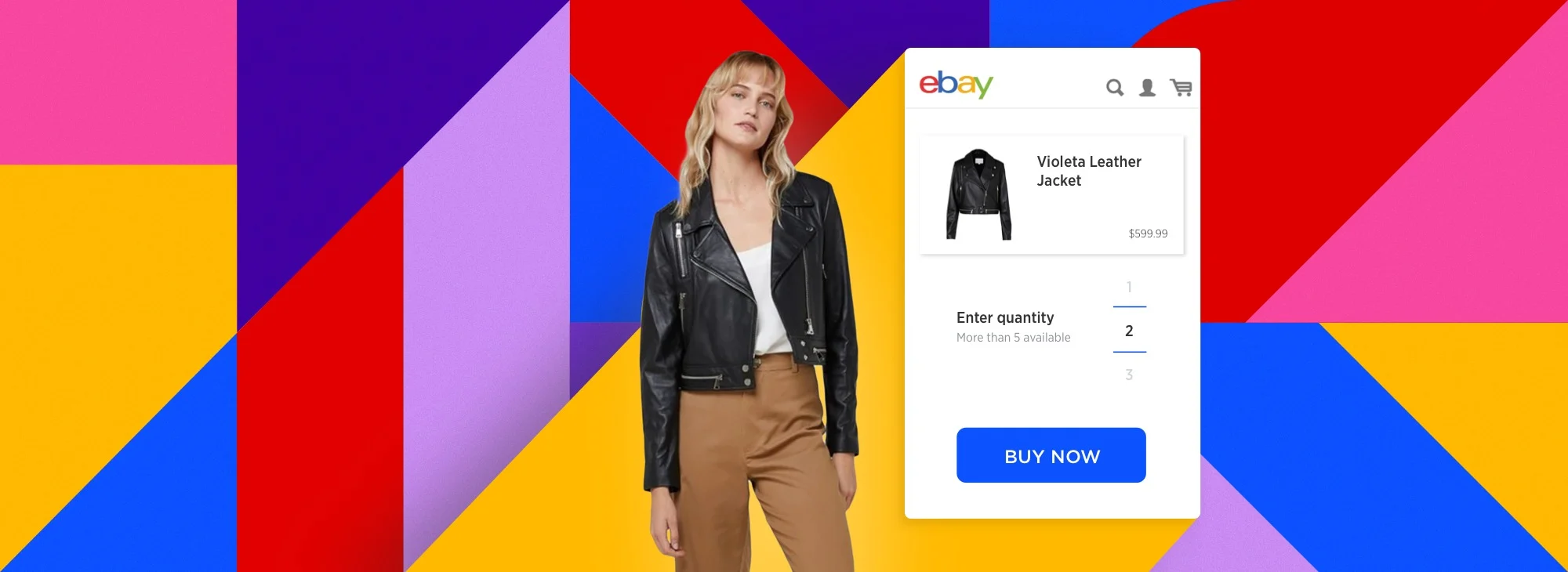

Starting in 2022, selling as little as $600 worth of stuff on a site like , or Facebook Marketplace, will prompt an IRS 1099-K.

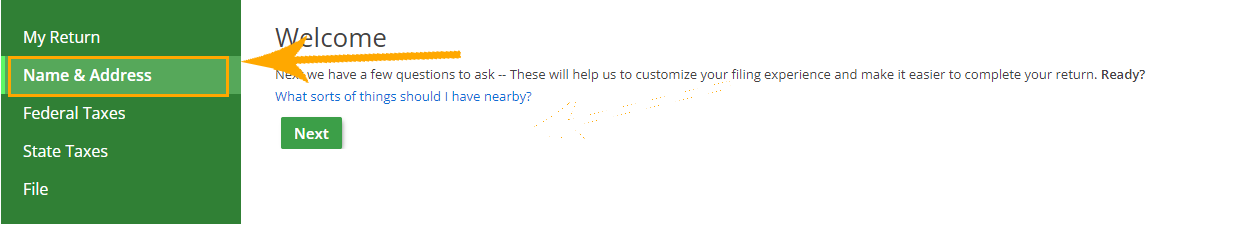

What Do I Need to Know About My 1099-K Tax Form? – Help

Connoisseur Brush Risslon Rigger #4 : Everything Else

New Updates from the IRS on 1099-K Forms: What You Need To Know - 5 Key Things You Should Know

How to Report Income on a 1099 Form -Simple Instructions

Women Conquer Business

Form 1099-K threshold for 2023

IRS Delays For A Year Onerous $600 Form 1099-K Reporting Threshold

Form 1099 Rules for Employers in 2023

IRS will delay $600 1099-K reporting for a year - Don't Mess With Taxes

:max_bytes(150000):strip_icc()/form1099-misc.asp-final-39ba7b1aef0143818239abc3fff14ae2.png)

1099-MISC Form: What It Is and What It's Used For

Recomendado para você

-

Mastercard23 dezembro 2024

Mastercard23 dezembro 2024 -

14 Items to Avoid Selling on23 dezembro 2024

14 Items to Avoid Selling on23 dezembro 2024 -

30% + $5 Off Coupon Codes → December 202323 dezembro 2024

30% + $5 Off Coupon Codes → December 202323 dezembro 2024 -

![vs : Where to Start Making Money? [Dec 2023 ]](https://litcommerce.com/blog/wp-content/uploads/2023/03/etsy-vs-ebay-e1682771182925.png) vs : Where to Start Making Money? [Dec 2023 ]23 dezembro 2024

vs : Where to Start Making Money? [Dec 2023 ]23 dezembro 2024 -

vs : Best marketplace in 202323 dezembro 2024

vs : Best marketplace in 202323 dezembro 2024 -

What is an example of?23 dezembro 2024

-

Aumente as vendas, liste todos os seus produtos no23 dezembro 2024

Aumente as vendas, liste todos os seus produtos no23 dezembro 2024 -

Raft of Top Firms Advise on €14B Buyout of -Backed Classifieds Business23 dezembro 2024

Raft of Top Firms Advise on €14B Buyout of -Backed Classifieds Business23 dezembro 2024 -

Discover Best Selling Items on in 2023 - Sellbery23 dezembro 2024

Discover Best Selling Items on in 2023 - Sellbery23 dezembro 2024 -

The Complete History Of The Logo - Logo Design Magazine23 dezembro 2024

The Complete History Of The Logo - Logo Design Magazine23 dezembro 2024

você pode gostar

-

Temple Run for Android - Download the APK from Uptodown23 dezembro 2024

-

Dragonfly Amusement - Pandora's Box 323 dezembro 2024

Dragonfly Amusement - Pandora's Box 323 dezembro 2024 -

PETER KLASEN (Germany, 1935). Olympic Centennial, 1992…23 dezembro 2024

-

Mrs. Robinson - Wikipedia23 dezembro 2024

Mrs. Robinson - Wikipedia23 dezembro 2024 -

15 JoJo Golden Wind Memes to Have a Golden Experience With - The Rockle23 dezembro 2024

15 JoJo Golden Wind Memes to Have a Golden Experience With - The Rockle23 dezembro 2024 -

Pin by Mundane Pointlessness on Noragami in 202323 dezembro 2024

Pin by Mundane Pointlessness on Noragami in 202323 dezembro 2024 -

The Sims 4: How to Get the Base Game for Free on PC, Mac23 dezembro 2024

The Sims 4: How to Get the Base Game for Free on PC, Mac23 dezembro 2024 -

Demon Slayer Season 2 Trailer Shows Off Entertainment District Arc and Mugen Train Arc - NYCC 2021 - IGN23 dezembro 2024

Demon Slayer Season 2 Trailer Shows Off Entertainment District Arc and Mugen Train Arc - NYCC 2021 - IGN23 dezembro 2024 -

Screech fanart23 dezembro 2024

-

Terraria - Did you know the Steampunker's inventory changes based on progression, world evil, moon phases, time of day, and events? Check out the Official Terraria Wiki to learn more! Gamepedia23 dezembro 2024