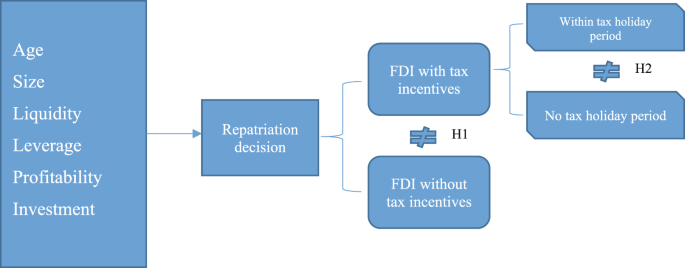

Tax holidays and profit-repatriation rates for FDI firms: the case of the Czech Republic

Por um escritor misterioso

Last updated 23 dezembro 2024

Foreign Direct Investment in Latin America and the Caribbean 2019

Foreign Direct Investment in Southeastern Europe: How (and How

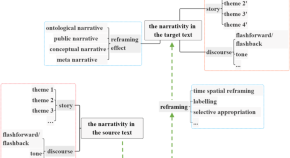

Articles in 2023 Humanities and Social Sciences Communications

The impact of housing macroprudential policy on firm innovation

Determinants of profit repatriation: Evidence from the Czech

World Investment Report 2015 - Reforming International Investment

Foreign investments - FasterCapital

A Global Perspective on Territorial Taxation

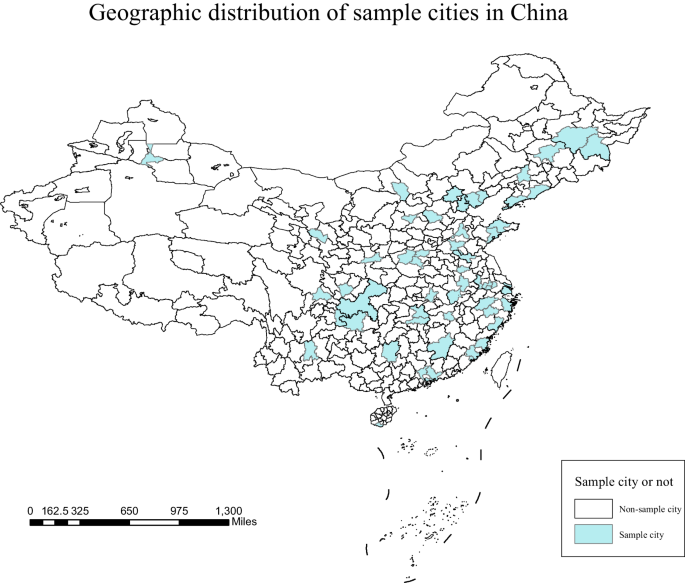

5 Foreign Direct Investment in China: Some Lessons for Other

Tax holidays and profit-repatriation rates for FDI firms: the case

Foreign Direct Investment in Southeastern Europe: How (and How

Recomendado para você

-

TIME CONTROL CONTABILIDADE23 dezembro 2024

-

Time Control Contabilidade23 dezembro 2024

-

.jpeg) Vaga Analista Financeiro em Fortaleza/Ce23 dezembro 2024

Vaga Analista Financeiro em Fortaleza/Ce23 dezembro 2024 -

Diversas vagas - Gestão e Negócios (27/01) - Central de Carreiras UniOpet23 dezembro 2024

Diversas vagas - Gestão e Negócios (27/01) - Central de Carreiras UniOpet23 dezembro 2024 -

tedeschipadilha (@tedeschipadilha) / X23 dezembro 2024

-

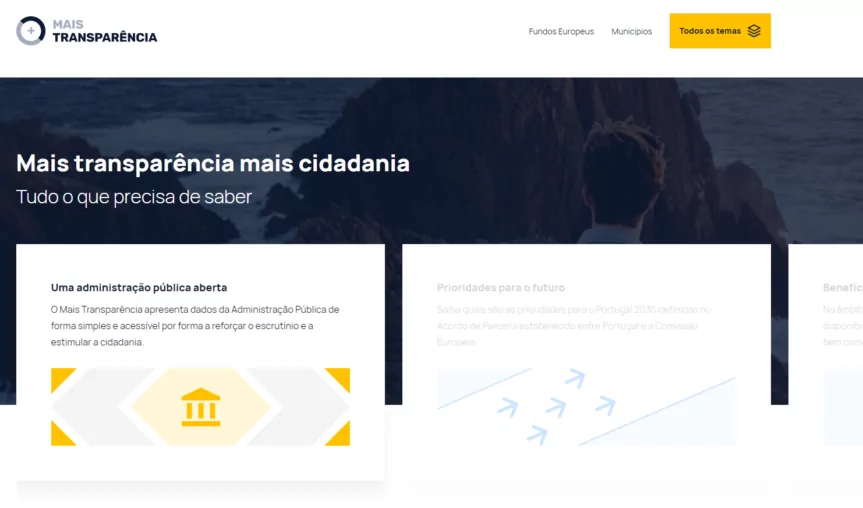

Digital Leaders Spotlight: Portal Mais Transparência, Portugal23 dezembro 2024

Digital Leaders Spotlight: Portal Mais Transparência, Portugal23 dezembro 2024 -

Nota fiscal: o que fazer ao não receber?23 dezembro 2024

Nota fiscal: o que fazer ao não receber?23 dezembro 2024 -

How can the asset management system transform micro and small companies?23 dezembro 2024

How can the asset management system transform micro and small companies?23 dezembro 2024 -

Henrique Cavalcante - Sócio - Control Contabilidade23 dezembro 2024

-

Relógio de ponto: é a melhor alternativa para controle de ponto23 dezembro 2024

Relógio de ponto: é a melhor alternativa para controle de ponto23 dezembro 2024

você pode gostar

-

Ensina Mais Turma da Mônica - Indaiatuba SP23 dezembro 2024

-

Luffy gear 5 wallpaper in 2023 Anime, One piece wallpaper iphone, Anime wallpaper23 dezembro 2024

Luffy gear 5 wallpaper in 2023 Anime, One piece wallpaper iphone, Anime wallpaper23 dezembro 2024 -

agachamento sumô barra livre23 dezembro 2024

agachamento sumô barra livre23 dezembro 2024 -

Kit Cauda De Sereia Adulto + Nadadeira + Top + Calcinha (biquíni Completo) / Roupa De Banho23 dezembro 2024

-

Resident Evil Tudo sobre Claire Redfield23 dezembro 2024

Resident Evil Tudo sobre Claire Redfield23 dezembro 2024 -

AFNOTE Pink Braiding Hair Extensions 3 Pack 24 Inch Synthetic High Temperature Jumbo Crochet Braids hair for braiding(Rouge Pink)23 dezembro 2024

AFNOTE Pink Braiding Hair Extensions 3 Pack 24 Inch Synthetic High Temperature Jumbo Crochet Braids hair for braiding(Rouge Pink)23 dezembro 2024 -

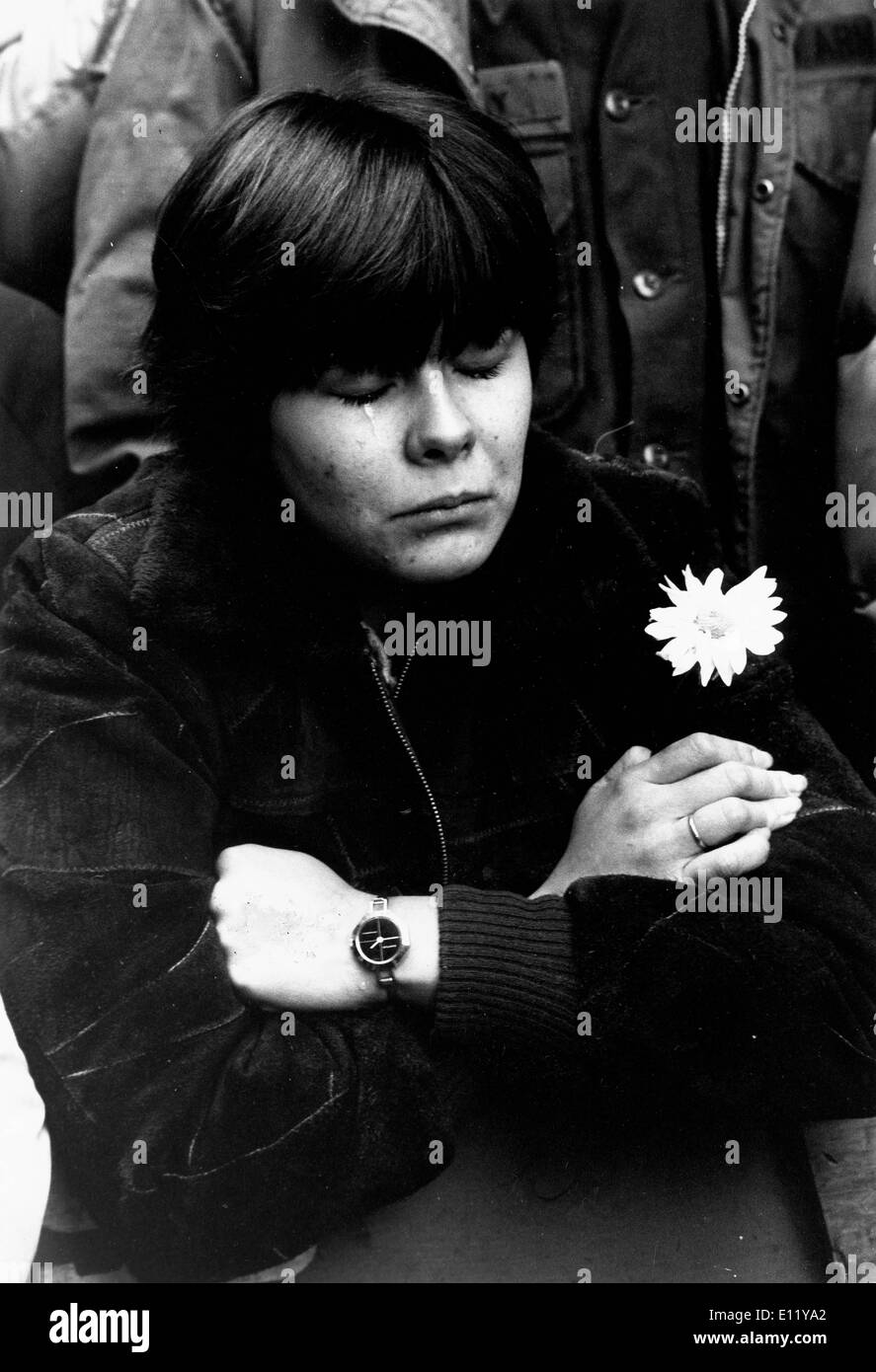

Woman mourns the death of former Beatles member, guitarist John23 dezembro 2024

Woman mourns the death of former Beatles member, guitarist John23 dezembro 2024 -

The quiz questions are the same as they were on the old site, but23 dezembro 2024

The quiz questions are the same as they were on the old site, but23 dezembro 2024 -

Joeschmo's Gears and Grounds: Kage no Jitsuryokusha ni Naritakute23 dezembro 2024

Joeschmo's Gears and Grounds: Kage no Jitsuryokusha ni Naritakute23 dezembro 2024 -

The World's Finest Assassin Gets Reincarnated in Another World as an Aristocrat, Vol. 1 (light novel) (The World's Finest Assassin Gets Reincarnated23 dezembro 2024

The World's Finest Assassin Gets Reincarnated in Another World as an Aristocrat, Vol. 1 (light novel) (The World's Finest Assassin Gets Reincarnated23 dezembro 2024