Ishka: SLB returns: Unlevered IRR and NPV analysis

Por um escritor misterioso

Last updated 22 dezembro 2024

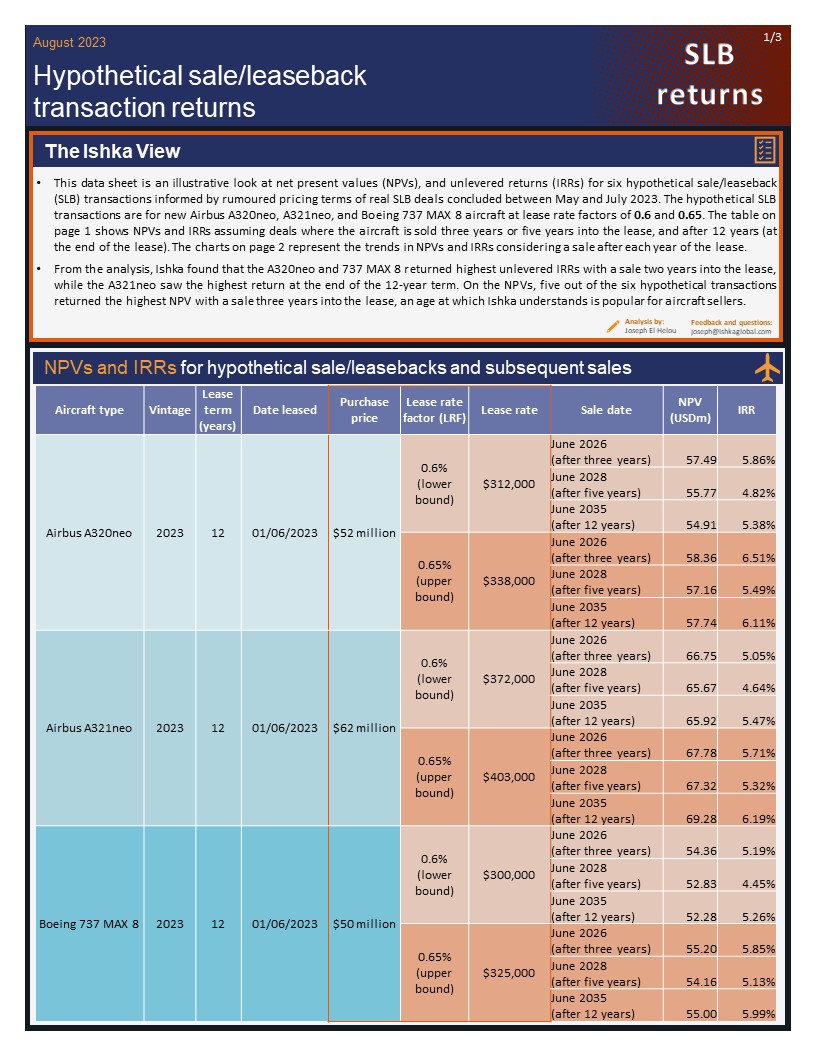

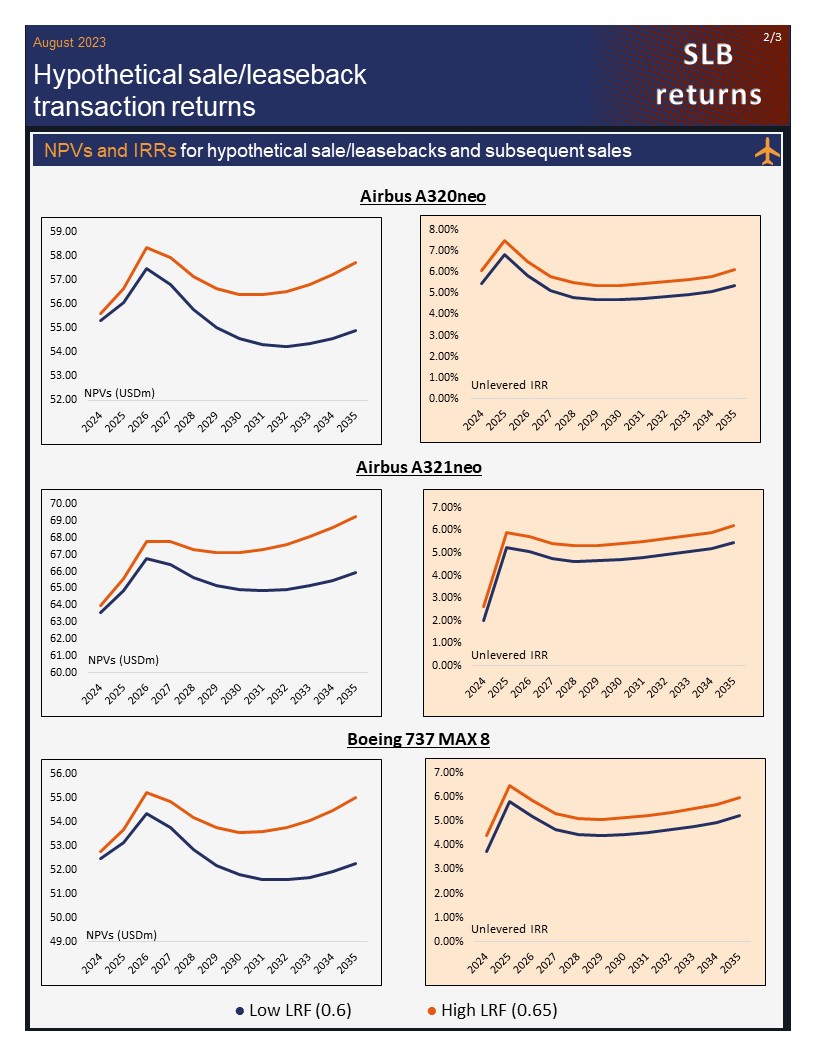

This data sheet is an illustrative look at net present values (NPVs), and unlevered returns (IRRs) for six hypothetical sale/leaseback (SLB) transactions informed by rumoured pricing terms of real SLB deals concluded between May and July 2023.

Ishka: SLB returns: Unlevered IRR and NPV analysis

Ishka: SLB returns: Unlevered IRR and NPV analysis

Ishka: Aviation Finance on LinkedIn: SLB returns: Unlevered IRR and NPV analysis

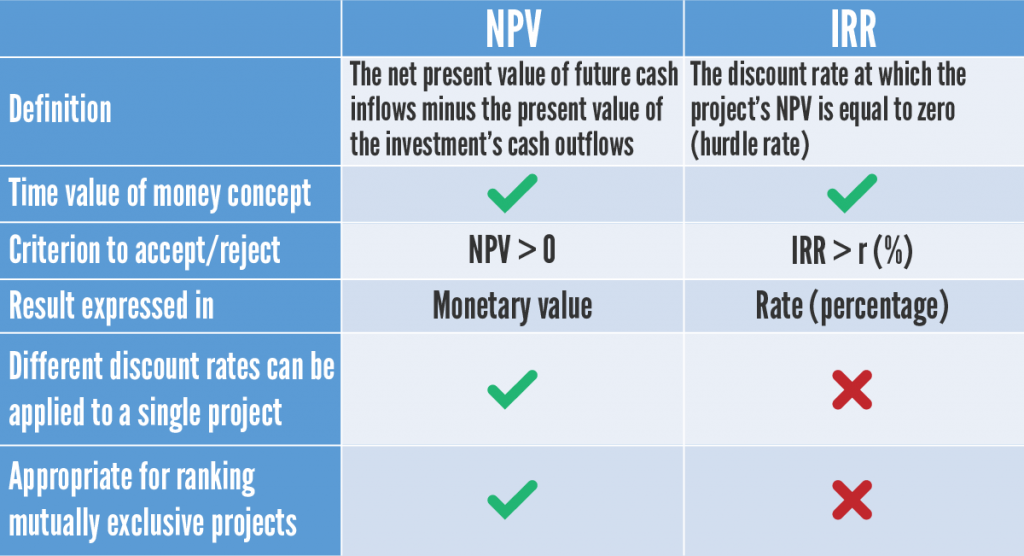

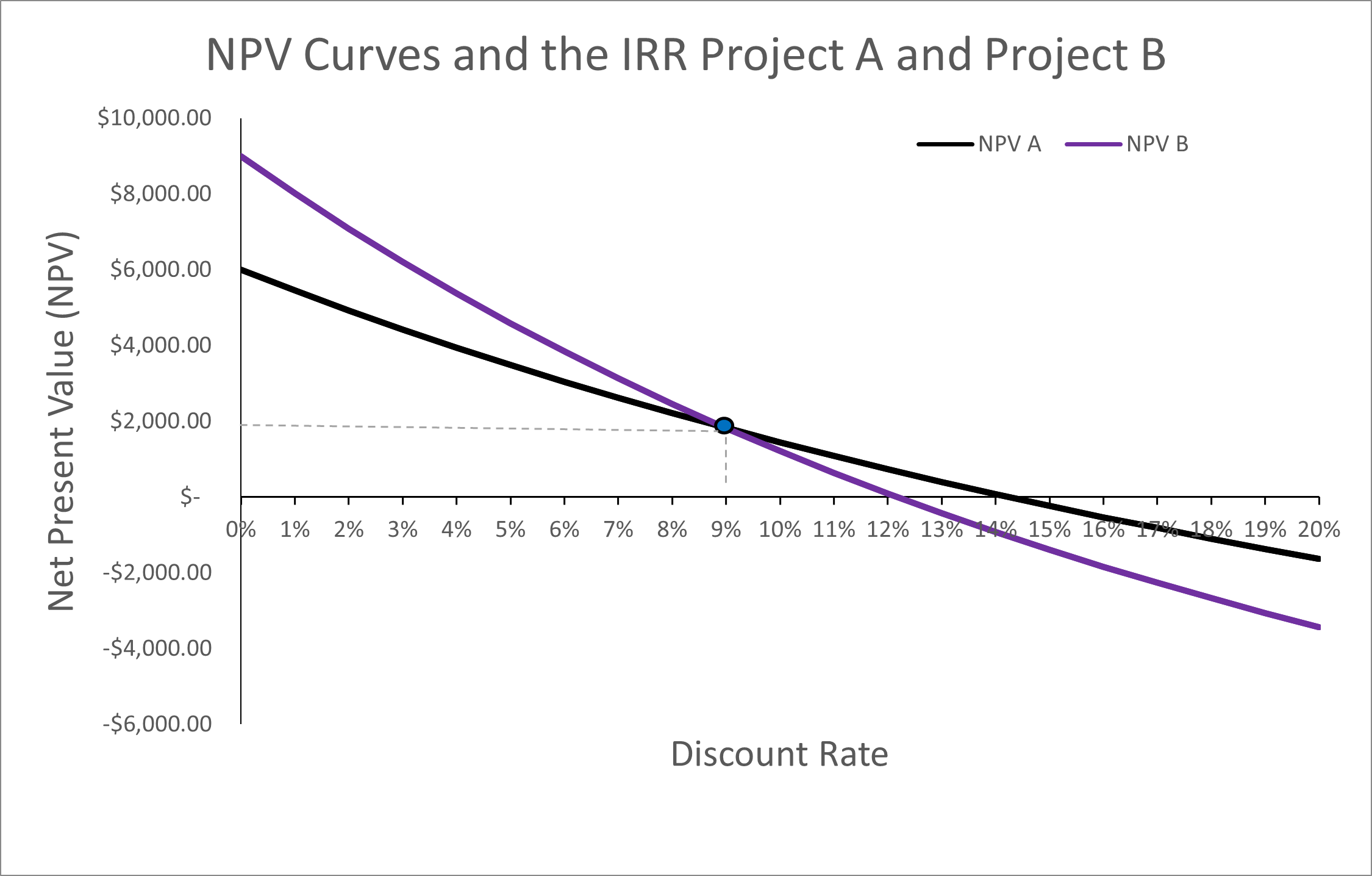

NPV vs. IRR – 365 Financial Analyst

Ishka: Aviation Industry Reports – Aviation Finance Market Data

Ishka: SLB returns: Unlevered IRR and NPV analysis

Sensitivity analysis for NPV versus IRR with respect to all model

IRR sensitivity graph 3.6.2. Net Present Value Sensitivity. The result

CFA Level 2 Alternative Inv: Private Real Estate Investment: Leveraged IRR and Unleveraged IRR

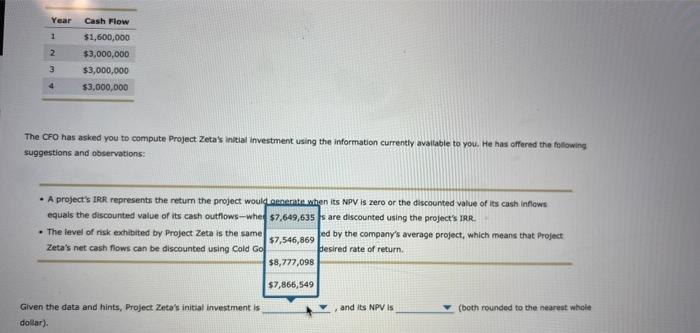

Solved 6. Understanding the IRR and NPV The net present

Chapter 2: Decisions, Decisions, Decisions. – Social Cost Benefit Analysis and Economic Evaluation

Recomendado para você

-

IRBSL22 dezembro 2024

-

IRBSL U15 Douar Sidi Lakhdar22 dezembro 2024

-

irbsl.com.br at WI. IRBSL – Instituto Rio Branco22 dezembro 2024

irbsl.com.br at WI. IRBSL – Instituto Rio Branco22 dezembro 2024 -

4Pcs Kawaii School Backpack Set,Cute Aesthetic Bear Canvas Bag,Handle Shoulder Pencil Case Tote Pouch Lunch Crossbody. (Black) : : Clothing, Shoes & Accessories22 dezembro 2024

4Pcs Kawaii School Backpack Set,Cute Aesthetic Bear Canvas Bag,Handle Shoulder Pencil Case Tote Pouch Lunch Crossbody. (Black) : : Clothing, Shoes & Accessories22 dezembro 2024 -

Imperial Range IRB-24NG 24 Natural Gas Radiant Countertop Charbroiler22 dezembro 2024

Imperial Range IRB-24NG 24 Natural Gas Radiant Countertop Charbroiler22 dezembro 2024 -

IRBR3.SA -, Stock Price & Latest News22 dezembro 2024

IRBR3.SA -, Stock Price & Latest News22 dezembro 2024 -

Ingersoll Rand Low Speed Buffer (IR327LS) - Tire Supply Network22 dezembro 2024

Ingersoll Rand Low Speed Buffer (IR327LS) - Tire Supply Network22 dezembro 2024 -

eProtocol - SLU - Protocol Management System22 dezembro 2024

eProtocol - SLU - Protocol Management System22 dezembro 2024 -

Cem Men's Clothing - CafePress22 dezembro 2024

Cem Men's Clothing - CafePress22 dezembro 2024 -

R$ 390 mil. 25 hectares, 100% plana, próximo ao rio urucuia, 24 km de Buritis-MG, 240 do DF22 dezembro 2024

R$ 390 mil. 25 hectares, 100% plana, próximo ao rio urucuia, 24 km de Buritis-MG, 240 do DF22 dezembro 2024

você pode gostar

-

Morre kevin Conroy, dublador oficial do Batman • DOL22 dezembro 2024

Morre kevin Conroy, dublador oficial do Batman • DOL22 dezembro 2024 -

/i.s3.glbimg.com/v1/AUTH_bc8228b6673f488aa253bbcb03c80ec5/internal_photos/bs/2021/8/t/EVopgbRVWoBbHcaXhSjg/img-20210510-135232-832.jpg) Apresentado no Manaus, Pedro releva briga por posição e se diz22 dezembro 2024

Apresentado no Manaus, Pedro releva briga por posição e se diz22 dezembro 2024 -

![Dragon Ball Super TCG: Power Absorbed [B20] Booster Box (24), Card Games](https://media.miniaturemarket.com/media/catalog/product/b/a/ban2650569-box_1.jpg) Dragon Ball Super TCG: Power Absorbed [B20] Booster Box (24), Card Games22 dezembro 2024

Dragon Ball Super TCG: Power Absorbed [B20] Booster Box (24), Card Games22 dezembro 2024 -

Code Club Global22 dezembro 2024

-

Grand Theft Auto 6 - Lucia Gameplay22 dezembro 2024

Grand Theft Auto 6 - Lucia Gameplay22 dezembro 2024 -

Sonic X: Episode 1 - Chaos Control Freaks22 dezembro 2024

Sonic X: Episode 1 - Chaos Control Freaks22 dezembro 2024 -

futebolbrasileiro #futquiz #quiz #escolha #brasil22 dezembro 2024

-

Receita Pratica de Frango Xadrez22 dezembro 2024

Receita Pratica de Frango Xadrez22 dezembro 2024 -

Create a breathtaking digital art or illustration of monika22 dezembro 2024

Create a breathtaking digital art or illustration of monika22 dezembro 2024 -

Guide For Pokemon Emerald Apk Download for Android- Latest version22 dezembro 2024

Guide For Pokemon Emerald Apk Download for Android- Latest version22 dezembro 2024