FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Last updated 31 dezembro 2024

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

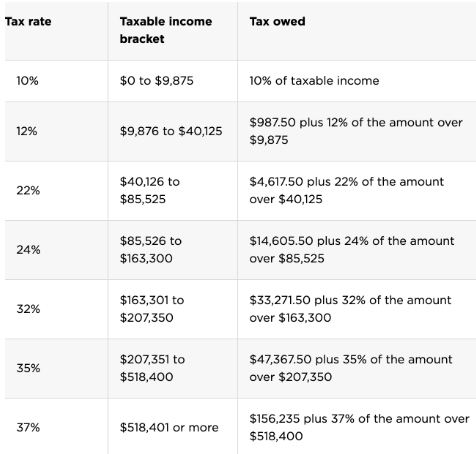

The Difference Between Marginal Tax Rates and Effective Tax Rates — and When to Use Them. - Thompson Wealth Management

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

NerdWallet 2023 Tax Report - NerdWallet

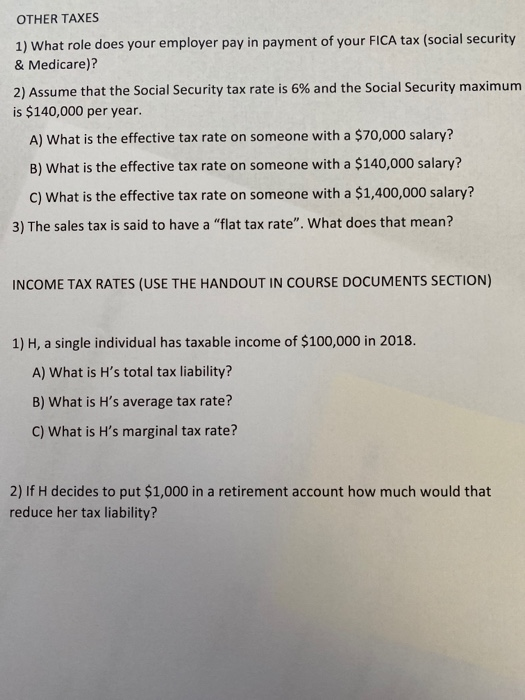

OTHER TAXES 1) What role does your employer pay in

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Payroll Taxes Filing Deadlines, Rates, and Employer Responsibilities

IRS Form 941: How to File Quarterly Tax Returns - NerdWallet

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Qualified Business Income Deduction (QBI): What It Is - NerdWallet

The Ultimate Small Business Guide for Tax Season 2023

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

Solved An employee earned $50,000 during the year. FICA tax

Recomendado para você

-

FICA Tax: What It is and How to Calculate It31 dezembro 2024

FICA Tax: What It is and How to Calculate It31 dezembro 2024 -

What is FICA Tax? - Optima Tax Relief31 dezembro 2024

What is FICA Tax? - Optima Tax Relief31 dezembro 2024 -

What is FICA tax?31 dezembro 2024

What is FICA tax?31 dezembro 2024 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes31 dezembro 2024

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes31 dezembro 2024 -

What is the FICA Tax Refund?31 dezembro 2024

What is the FICA Tax Refund?31 dezembro 2024 -

What Eliminating FICA Tax Means for Your Retirement31 dezembro 2024

-

IRS Form 843 - Request a Refund of FICA Taxes31 dezembro 2024

IRS Form 843 - Request a Refund of FICA Taxes31 dezembro 2024 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com31 dezembro 2024

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com31 dezembro 2024 -

FICA Tax - An Explanation - RMS Accounting31 dezembro 2024

FICA Tax - An Explanation - RMS Accounting31 dezembro 2024 -

Students on an F1 Visa Don't Have to Pay FICA Taxes —31 dezembro 2024

Students on an F1 Visa Don't Have to Pay FICA Taxes —31 dezembro 2024

você pode gostar

-

Transparent Silly Face Png - Roblox Faces Clipart, clipart, png clipart31 dezembro 2024

Transparent Silly Face Png - Roblox Faces Clipart, clipart, png clipart31 dezembro 2024 -

XO: Tic Tac Toe - Microsoft Apps31 dezembro 2024

-

Far Cry 2 - Cadê o Game - Personagens31 dezembro 2024

Far Cry 2 - Cadê o Game - Personagens31 dezembro 2024 -

Tabuleiro de Xadrez e Damas Cayro Madeira31 dezembro 2024

Tabuleiro de Xadrez e Damas Cayro Madeira31 dezembro 2024 -

Upcoming Nintendo Switch games – September 2023, News31 dezembro 2024

Upcoming Nintendo Switch games – September 2023, News31 dezembro 2024 -

Toon Clash Chess::Appstore for Android31 dezembro 2024

Toon Clash Chess::Appstore for Android31 dezembro 2024 -

XADREZ31 dezembro 2024

XADREZ31 dezembro 2024 -

Peão do Valle & Valentin - Lágrimas na Areia (Album Completo - LANÇAMENTO)31 dezembro 2024

Peão do Valle & Valentin - Lágrimas na Areia (Album Completo - LANÇAMENTO)31 dezembro 2024 -

Wonder Woman 1984 - Cheetah, and Wonder Woman and Young Diana Statues by Iron Studios - The Toyark - News31 dezembro 2024

Wonder Woman 1984 - Cheetah, and Wonder Woman and Young Diana Statues by Iron Studios - The Toyark - News31 dezembro 2024 -

Vampire: The Masquerade - Bloodlines GAME MOD 7 New Clans addon v.3.6 - download31 dezembro 2024

Vampire: The Masquerade - Bloodlines GAME MOD 7 New Clans addon v.3.6 - download31 dezembro 2024