How Do the Used and Commercial Clean Vehicle Tax Credits Work?

Por um escritor misterioso

Last updated 31 dezembro 2024

Beginning in 2023, there are two new EV tax credits: the Used Clean Vehicle Credit and the Commercial Clean Vehicle Credit. Here’s what you need to know.

How Do the Used and Commercial Clean Vehicle Tax Credits Work?

Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit - TurboTax Tax Tips & Videos

Used EV Tax Credits and the Electric Cars Eligible Today

:max_bytes(150000):strip_icc()/6-ways-to-write-off-your-car-expenses.aspx-Final-97003f07090546d99b4e2cf41c552cbd.jpg)

6 Ways to Write Off Your Car Expenses

Commercial Clean Vehicle Credit: What You Need to Know - Withum

Every electric vehicle tax credit rebate available, by state

Going Green: States with the Best Electric Vehicle Tax Incentives

Clean Energy Tax Credits Get a Boost in New Climate Law, Article

Frequently Asked Questions: 2023 Clean Energy and Electric Vehicle Tax Credits - Alloy Silverstein

Recomendado para você

-

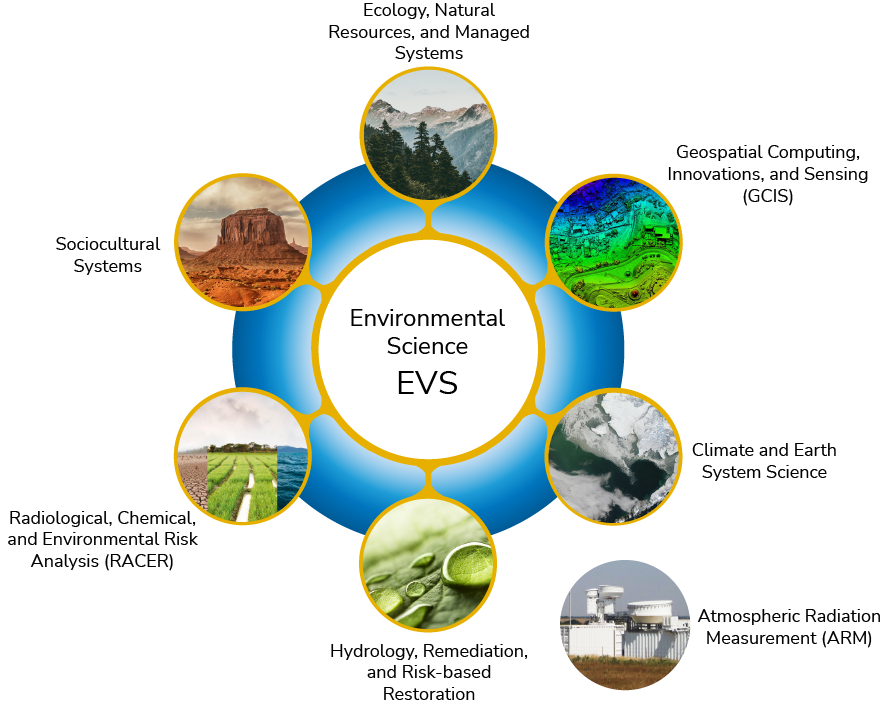

EVS Departments Argonne National Laboratory31 dezembro 2024

EVS Departments Argonne National Laboratory31 dezembro 2024 -

EVs explained: How do electric cars actually work and are they really better than traditional cars?31 dezembro 2024

EVs explained: How do electric cars actually work and are they really better than traditional cars?31 dezembro 2024 -

iFood e Voltz irão vender a moto elétrica EVS Work por menos de R$ 10 mil – Veículo Elétrico Blog31 dezembro 2024

iFood e Voltz irão vender a moto elétrica EVS Work por menos de R$ 10 mil – Veículo Elétrico Blog31 dezembro 2024 -

CBSE Class 3 EVS Work We Do Worksheet31 dezembro 2024

-

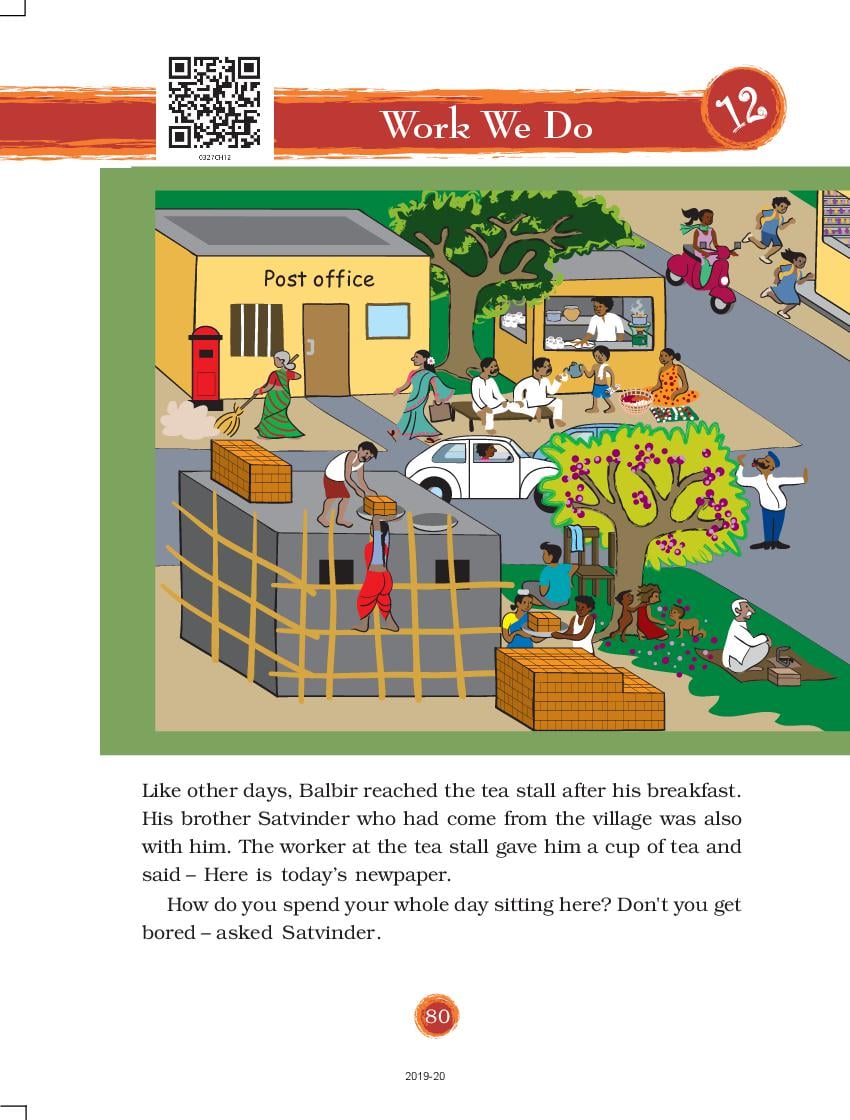

NCERT Book Class 3 EVS Chapter 12 Work We Do31 dezembro 2024

NCERT Book Class 3 EVS Chapter 12 Work We Do31 dezembro 2024 -

NCERT Solutions for Class 3 EVS Chapter 12 Work We Do31 dezembro 2024

NCERT Solutions for Class 3 EVS Chapter 12 Work We Do31 dezembro 2024 -

EVS Tech Job Description31 dezembro 2024

EVS Tech Job Description31 dezembro 2024 -

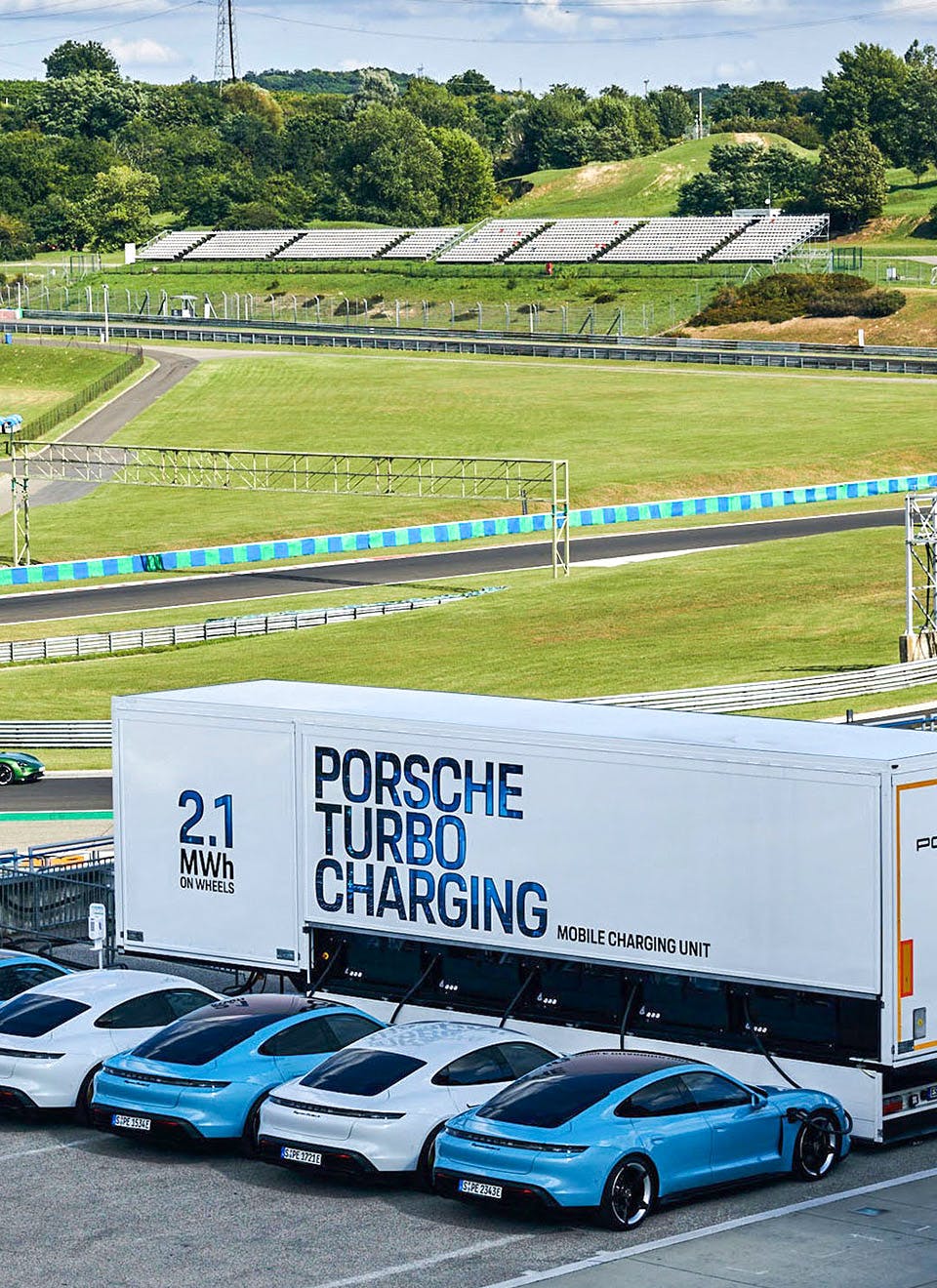

What is the Porsche Turbo Charging trailer?31 dezembro 2024

-

The answer to making your EVs work harder is here - Smartrak31 dezembro 2024

The answer to making your EVs work harder is here - Smartrak31 dezembro 2024 -

How Do EVs Work31 dezembro 2024

How Do EVs Work31 dezembro 2024

você pode gostar

-

Xbox Cloud Gaming chega aos consoles Xbox Series X, S e Xbox One no Brasil31 dezembro 2024

Xbox Cloud Gaming chega aos consoles Xbox Series X, S e Xbox One no Brasil31 dezembro 2024 -

Hunger Games GIF - Find & Share on GIPHY Hunger games, Hunger games humor, Jennifer lawrence hunger games31 dezembro 2024

Hunger Games GIF - Find & Share on GIPHY Hunger games, Hunger games humor, Jennifer lawrence hunger games31 dezembro 2024 -

Candy Crush Saga atinge 500 milhões de downloads31 dezembro 2024

-

Doors SUPER HARD MODE Level 50 Library Walkthrough (ROBLOX)31 dezembro 2024

Doors SUPER HARD MODE Level 50 Library Walkthrough (ROBLOX)31 dezembro 2024 -

Emmys 2018: 'Game of Thrones' and 'Marvelous Mrs. Maisel' Win Big Awards - The New York Times31 dezembro 2024

Emmys 2018: 'Game of Thrones' and 'Marvelous Mrs. Maisel' Win Big Awards - The New York Times31 dezembro 2024 -

steam deck preço em dolar31 dezembro 2024

steam deck preço em dolar31 dezembro 2024 -

CR7 supera marca de 15 anos e vira o maior artilheiro de seleções31 dezembro 2024

CR7 supera marca de 15 anos e vira o maior artilheiro de seleções31 dezembro 2024 -

Manchester United vs Arsenal: Kick-off time, live stream info and how to watch on TV31 dezembro 2024

Manchester United vs Arsenal: Kick-off time, live stream info and how to watch on TV31 dezembro 2024 -

My Dress-Up Darling Bromide Collection (Set of 8) (Anime Toy) - HobbySearch Anime Goods Store31 dezembro 2024

My Dress-Up Darling Bromide Collection (Set of 8) (Anime Toy) - HobbySearch Anime Goods Store31 dezembro 2024 -

Flamengo chega a acordo com estafe de Isco e aguarda resposta definitiva do meia ex-Real Madrid, diz portal espanhol - Coluna do Fla31 dezembro 2024

Flamengo chega a acordo com estafe de Isco e aguarda resposta definitiva do meia ex-Real Madrid, diz portal espanhol - Coluna do Fla31 dezembro 2024