Are Gift Cards Taxable to Employees?

Por um escritor misterioso

Last updated 23 dezembro 2024

Are gift cards taxable? If your business purchases gift cards for employees, make sure you’re not missing this important reporting step.

What Employers Should Know about Giving Gifts to Employees - Rincker Law

Are gift cards taxable employee benefits?

Must-Know Tax Rules for Employee Gift Cards

Employee Based Rewards - Gift Cards: What You Need to Know

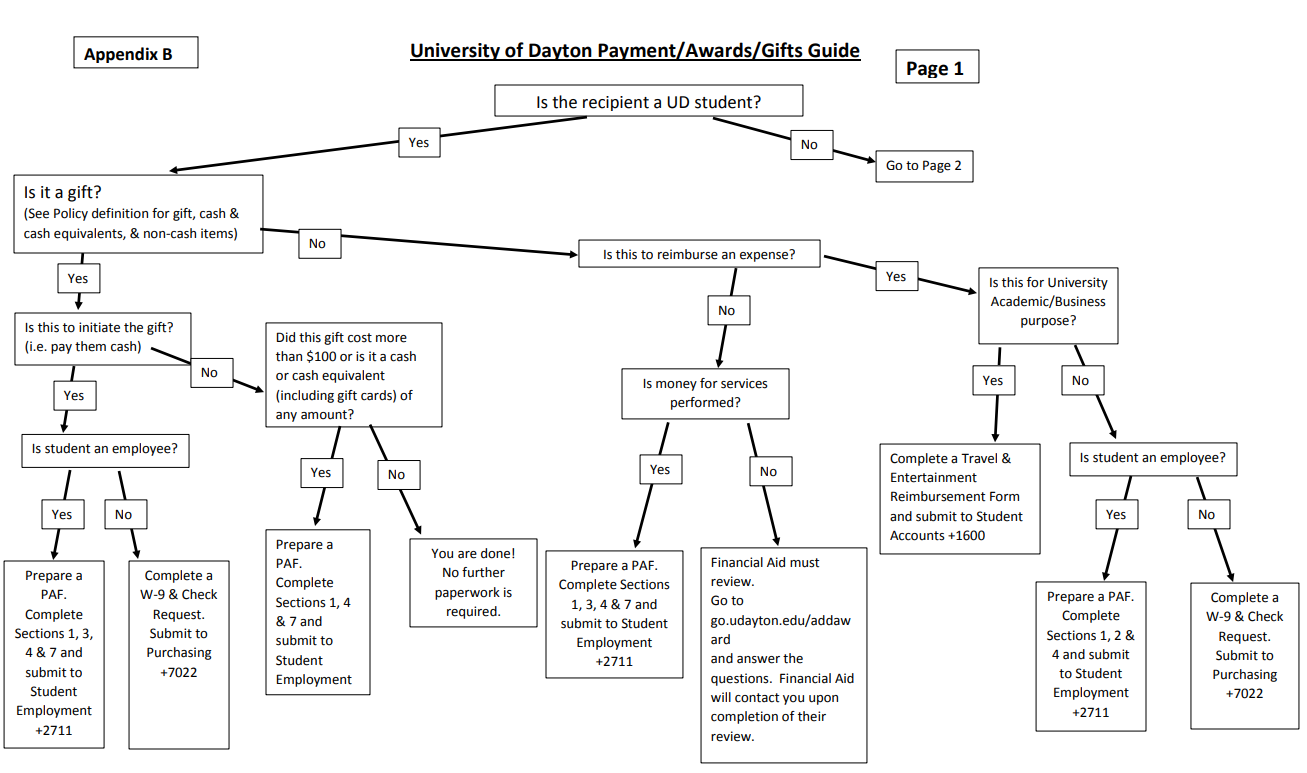

Awards, Gifts, and Prizes Policy : University of Dayton, Ohio

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages

FAQ: Are Gift Cards for Employees a Tax Deduction?

The Tax Implications of Employee Gifts - Hourly, Inc.

What Counts as Taxable and Non-Taxable Income for 2023

Bonuses, Gifts & Fringe Benefits: Taxable and Deductible

Is There Tax On Gift Cards - Are Gift Cards Taxable?

Are Employee Gifts Taxable? What You Need to Know

Turkey Corporate Gift Certificates

What employers need to know about employee gifts

Recomendado para você

-

Can I buy I bonds as a gift for someone else?23 dezembro 2024

Can I buy I bonds as a gift for someone else?23 dezembro 2024 -

:max_bytes(150000):strip_icc()/gif-gettyimages-re-215ebb8f3199469184954bdbf85a5d81.jpg) Is It Customary to Bring Wedding Gifts to a Reception?23 dezembro 2024

Is It Customary to Bring Wedding Gifts to a Reception?23 dezembro 2024 -

Best Christmas gift I ever received : Pop Culture Happy Hour : NPR23 dezembro 2024

Best Christmas gift I ever received : Pop Culture Happy Hour : NPR23 dezembro 2024 -

Receiving gifts warms my heart – The Mirror23 dezembro 2024

Receiving gifts warms my heart – The Mirror23 dezembro 2024 -

Researchers find the worst reason to give a gift23 dezembro 2024

Researchers find the worst reason to give a gift23 dezembro 2024 -

Gift Ideas23 dezembro 2024

Gift Ideas23 dezembro 2024 -

:max_bytes(150000):strip_icc()/gift-present-wrapped-paper-ribbon-giving-1460013-pxhere.com-f9d8d3d78f904a389a2819c138ea53b9.jpg) Gift-Giving Etiquette: A Brief Guide23 dezembro 2024

Gift-Giving Etiquette: A Brief Guide23 dezembro 2024 -

47 best gag gifts to make anyone laugh in 2023 - TODAY23 dezembro 2024

47 best gag gifts to make anyone laugh in 2023 - TODAY23 dezembro 2024 -

Exquisite Scandinavian Christmas gifting23 dezembro 2024

Exquisite Scandinavian Christmas gifting23 dezembro 2024 -

2023 Best Gift Ideas - Find the Perfect Birthday and Christmas Presents for Everyone23 dezembro 2024

2023 Best Gift Ideas - Find the Perfect Birthday and Christmas Presents for Everyone23 dezembro 2024

você pode gostar

-

Roblox: Promo Codes for Free Stuff (April 2021)23 dezembro 2024

Roblox: Promo Codes for Free Stuff (April 2021)23 dezembro 2024 -

De Pano e Alma Bonecas - Boneca de Pano Vivi Coleção Meu Estilo23 dezembro 2024

De Pano e Alma Bonecas - Boneca de Pano Vivi Coleção Meu Estilo23 dezembro 2024 -

Horror Sans by ElectoSteths on DeviantArt23 dezembro 2024

Horror Sans by ElectoSteths on DeviantArt23 dezembro 2024 -

Pin by luffy🍖Taro on luffy//icons One piece funny, Manga anime one piece, Luffy23 dezembro 2024

Pin by luffy🍖Taro on luffy//icons One piece funny, Manga anime one piece, Luffy23 dezembro 2024 -

GAMMA 2 S.H.Figuarts GAMA SHF Dragon ball Z Super Hero Figure PB23 dezembro 2024

GAMMA 2 S.H.Figuarts GAMA SHF Dragon ball Z Super Hero Figure PB23 dezembro 2024 -

Download do APK de Livro Colorir Garten Banban para Android23 dezembro 2024

Download do APK de Livro Colorir Garten Banban para Android23 dezembro 2024 -

Pokémon Shining Pearl' completed in just 33 minutes23 dezembro 2024

Pokémon Shining Pearl' completed in just 33 minutes23 dezembro 2024 -

Shuumatsu no Harem terá versão sem censura - Anime United23 dezembro 2024

Shuumatsu no Harem terá versão sem censura - Anime United23 dezembro 2024 -

Edit sacode os ossos exu caveira|TikTok Search23 dezembro 2024

Edit sacode os ossos exu caveira|TikTok Search23 dezembro 2024 -

how to trade for control fruit|TikTok Search23 dezembro 2024

how to trade for control fruit|TikTok Search23 dezembro 2024